The tariff discussions that defined the first half of 2025 have thrown the global economy a curveball. The travel and hospitality sector, in particular, has recalibrated its outlook, with some global hotel brands lowering their RevPAR guidance as they navigate the current climate with a mix of caution and quiet confidence.

Consumer uncertainty triggered by trade tensions, combined with a global rise in the cost of living, political instability, and stricter travel advisories, may be weighing slightly on hotel demand. But the underlying global travel boom remains intact, and Irish hotels can learn from this momentum.

The accelerating rise of the experience economy

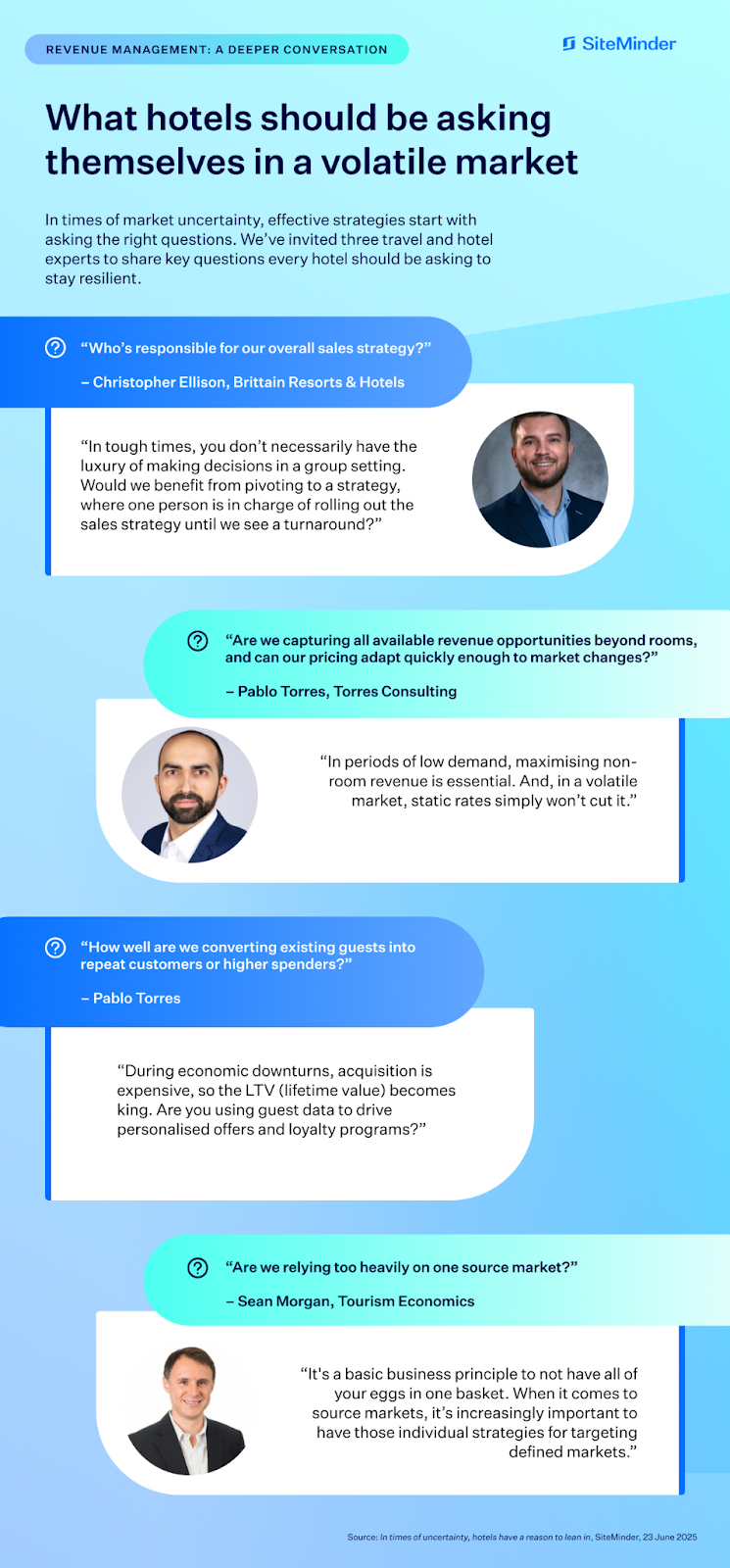

Sean Morgan, Head of Travel Industry Research at Tourism Economics, emphasises that 2025 is still on track to achieve over 1.6 billion international tourist arrivals, nearly 10 percent above 2019 levels.

A driving force behind this recovery is the continued rise of the experience economy. While demand for meaningful travel had already gained traction pre-pandemic, Morgan notes a sharp acceleration since. More travellers are prioritising immersive cultural experiences over material goods, a promising trend for hotels, particularly as one in five global travellers is likely to return to a property because of its local community ties, according to SiteMinder’s Changing Traveller Report 2025.

Hospitality consultant Pablo Torres says local offers, like bonus loyalty points or nearby stay packages, can boost domestic travel. “Some companies offer extra points to loyal customers who travel locally,” he explains. “It’s about targeting people driving nearby rather than flying in. You’re rewarding the domestic traveller with tailored bundles.”

This shift has also prompted a rethink of loyalty programs. Instead of long-term point accumulation, guests now prefer instant rewards they can use during their stay, such as spa credits or F&B perks. “It encourages guests to think, ‘Hey, this company is offering more,’” says Torres. “It’s about delivering more value for the same money.”

Ancillary revenue and bottom-line focus

Christopher Ellison, Vice President of Revenue at Brittain Resorts and Hotels, stresses that value is now outperforming discounts. Guests increasingly ask, “What’s included?” rather than focusing solely on price. Rather than cutting rates, hotels are enhancing their non-room offerings — think 'Instagrammable' food and drink — to drive spending while maintaining rate integrity.

Torres adds that relying solely on room revenue, especially when occupancy is moderate, restricts a hotel’s full potential. “Offering different experiences throughout the day adds revenue,” he says. Flexibility matters; guests may opt out of housekeeping or choose pay-per-use cancellation options, personalising their stay while helping protect hotel margins.

Some properties are also scrutinising fixed costs such as labour, property taxes, and long-term service contracts to improve profitability. Ellison points out, however, that these are often the toughest costs to adjust. “It’s not just about top-line revenue. You have to evaluate every cost, especially fixed ones,” he says.

There’s a growing understanding that revenue and operations teams must collaborate more closely. Revenue managers focus on driving bookings, but in volatile markets, knowing how that revenue flows through to profit is essential. “Just because you’re in a down market doesn’t mean your bottom line has to be down, if you manage your costs effectively,” Ellison says.

Looking ahead with confidence

“I think resilience is just in the blood of the hospitality industry—and tied closely to innovation,” Morgan notes. “It’s about understanding people’s needs and responding to them.”

Early signals are encouraging. “Spring Break performed exceptionally well, and historically that predicts a strong summer,” says Ellison. “While broader economic stability remains a factor, we’re confident the industry has likely bottomed out, and current demand suggests we’re turning a corner.”

If you want more information on what this means for your property, click here or send an email to sophie.scullion@siteminder.com

Contact details

Sophie Scullion +44 20 3151 0101 sophie.scullion@siteminder.comWeb www.siteminder.com